What Is the Cost of Capital vs. Discount Rate?

The cost of capital and the discount rate are often used interchangeably, but they serve distinct purposes in financial decision-making. The cost of capital, calculated by a company’s finance department, measures the minimum return required to justify an investment. In contrast, the discount rate is a management-set threshold that projects must exceed to be considered viable.

Key Differences Between Cost of Capital and Discount Rate

Definition:

Cost of Capital: Reflects the breakeven point for a project, covering funding costs through debt and equity.

Discount Rate: Incorporates risk adjustments and represents the hurdle rate a project must surpass.

Calculation:

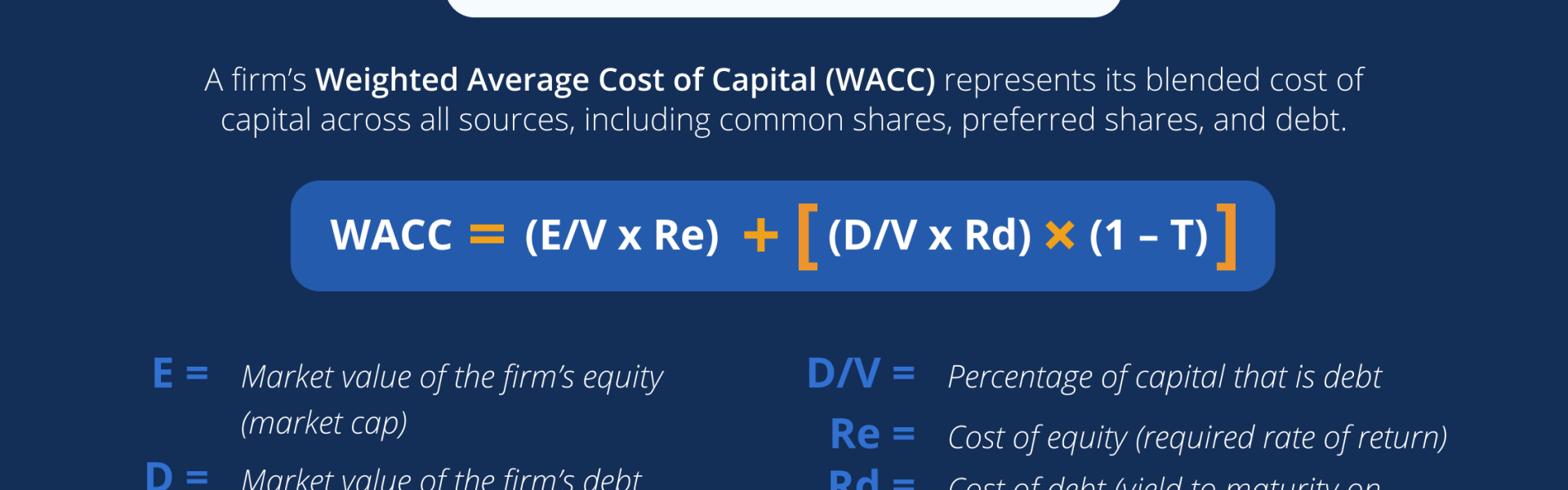

The cost of capital is derived using the weighted average cost of capital (WACC), factoring in the cost of equity and debt.

The discount rate often builds on the cost of capital, adding a risk premium based on project uncertainties.

Usage:

Cost of Capital: Guides funding decisions and evaluates financial feasibility.

Discount Rate: Assesses whether projects can generate enough return to justify investment.

Why Cost of Capital Is Important

The cost of capital plays a central role in evaluating the efficiency of resource allocation. Here’s why:

Investment Benchmark: A project with returns exceeding the cost of capital generates value, while lower returns indicate inefficient spending.

Valuation Tool: High capital costs can diminish investor confidence, affecting company valuation.

Industry Comparison: Helps benchmark profitability expectations across industries.

Cost of Capital by Industry

The cost of capital varies significantly across industries, influenced by investment requirements and risk levels:

High-Cost Industries: Software, semiconductors, and paper/forest sectors often exceed 9%, driven by capital-intensive operations.

Low-Cost Industries: Power companies, real estate developers, and financial services typically hover around 5%, benefiting from stable cash flows.

For example, according to NYU’s Stern School of Business, homebuilding averages a 9.28% cost of capital, while grocery retail sits at 5.31%.

The Role of Discount Rate in Decision-Making

Management uses the discount rate to set an investment benchmark. It reflects not only funding costs but also:

Risk Assessment: Higher-risk projects may carry elevated discount rates to account for uncertainty.

Project Prioritization: Innovative but risky initiatives typically require a higher return to justify investment compared to routine upgrades or maintenance projects.